Iver Property Market Update: February 2023

- With the Bank of England raising interest rates and inflation high, what is happening in the Iver property market?

- Are properties selling in Iver? And if so, what is selling?

- What will happen to the value of your Iver home?

- Read the article to find out what is happening to the Iver property market.

As we enter February, the Iver (and British) property market is full of mixed messages.

Whilst the Bank of England increased the base rate nine times in 2022, meaning they are now at 4.00% (3.50% higher than 12 months ago), mortgage rates are now dropping.

The Iver property market rocketed over the last few years because of the imbalance of the number of properties for sale versus the demand, with many more people looking to move home than there were properties available.

Now, as we are over the first month of 2023, we are experiencing a steadier Iver housing market, where homebuyers have the time and opportunity to ensure they find the right home for them.

The days of 50 viewers per property on the first weekend of marketing, frenzied Iver buyers outbidding each other by increasing their offers by tens of thousands of pounds over the asking price has become the exception and not the norm.

I often get asked my thoughts on the Iver property market (hence these blog articles) and at this time of year, I get asked my forecast for the year ahead.

The one big thing I have noticed is the imbalance of what is coming on the market for sale versus what is selling.

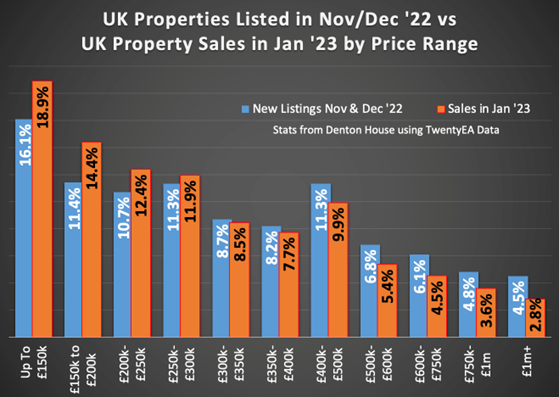

For example, 38.2% of properties that came on the market nationally in November and December 2022 had an asking price of £250,000 or less, yet 45.6% of the properties sold subject to contract since 1st January 2023 have been £250,000 or less.

That doesn't sound like a lot, yet it makes a massive difference to the property market.

However, it’s very easy to look at national averages, regional averages, and, of course, Iver averages. Yet the property market is just one market nationally, as there isn't just one Iver property market.

However, the same pattern is seen in the higher-priced Iver properties. These higher-priced properties are selling more slowly than the lower-priced Iver properties. Therefore, the need for those larger Iver properties to be more realistic in price is paramount to stand out from the crowd, especially with the next point.

Evidence suggests there is a growth of Iver buyers, who are looking to find a home before putting theirs onto the market. This was unthinkable last year, yet as the Iver property market returns to normality, this will be seen more and more.

What are my thoughts?

Firstly, the time scale of how long it will take to sell a Iver home.

I expect to see the time it takes to sell a Iver home increase from 64 days in 2022 to a more 'normal' housing market of around 85 days.

Secondly, the imbalance of the Iver property market.

A greater number of larger homes in Iver are coming on the market because (as mentioned recently in a previous blog post) of the higher number of mature homeowners looking to downsize. This is because these larger homes have become much more expensive to heat, and as many of the occupants are on fixed incomes with their pensions, they are downsizing to cut costs.

Thirdly, that brings me to talk about energy efficiency.

Many buyers have started to ask about a property's Energy Performance Certificate (EPC) rating. I recommend to Iver homeowners considering moving in the spring or summer to have an EPC done on their property now, as there may be points that could easily be rectified and improved from one EPC rating band to another.

This would mean you will get a lot more interest and a better price for your property. If you need any help or guidance in organising an EPC on your Iver property (even if you are not selling for six/twelve months), do not hesitate to me give me a call.

So, what is happening in the Iver property market in terms of new properties (aka new listings), and what is selling?

5 properties sold (STC) in the Iver area in January 2023.

(Iver being SL0).

However, it's essential to look at what is selling in Iver, and the most active price range is the £600k to £750k range, where 2 properties have been sold subject to contract (representing 40.00% of sales).

Looking at what is coming onto the market in the same time frame …

18 properties came onto the market in the Iver area in January 2023.

Yet the price range with the most listings is the £750k to £1m range. Again, this backs up the idea that the lower to middle of the Iver property market is where the sales are, but the properties coming onto the market are slightly higher in price.

This means those Iver homeowners with properties in those middle to upper price ranges need to be ‘on point’ to stand out from the crowd regarding their marketing, be spot on regarding their pricing (compared to the growing competition of other larger homes for sale) and now more than ever, their EPC rating (especially if they are on the cusp between two EPC bands).

Before I conclude, you might wonder why I have not mentioned Iver house prices.

Well, what will happen to Iver house prices in 2023 is something I am not sure of.

(Yes, I know that level of frankness is strange coming from an estate/letting agent).

I know the prices being achieved for homes in Iver in the spring of 2022 (when everyone was outbidding each other) are not being achieved today. It all depends on how you look at it.

Are Iver house prices dropping or are they just returning to normal? I would say the latter.

However, looking at house prices as a ‘bellwether’ for the health of the Iver property market has flaws.

Many economists and property market commentators believe transaction numbers (the number of properties sold) give a more accurate and truthful indicator of the property market's health than just house values alone.

The reason is three-fold.

Firstly, most people also buy a home when they sell their own, so if Iver property values drop by 10% or rise by 10% on the one you are selling, it will do the same on the one you are buying - meaning to judge the health of a property market on house prices is very one dimensional.

Secondly, as most people move up the market when they do move home if the price of the one they’re selling might not be as much as they would've achieved in 2022 (if they drop), the price that they will pay on the one they want to buy will be lower. Thus, it will cost them less to move upmarket!

E.g. Last year, your Iver home was worth £400,000, and the one you wanted to buy would have been £750,000. Let’s say Iver house prices did drop 10% in 2023 (which I don’t know if they will); your home would be only worth £360,000. Yet the one you want to buy would now be worth £675,000. So last year, it would have cost £350k to move, but if Iver house prices drop 10%, the move would cost £315k, saving you £35,000.

Third and finally, moving home is a human thing. Property habitually delivers a robust emotional connection with homeowners - a connection that few would attribute to their other investments like their stock market investments or building society savings passbook.

Moving home could be described as a human journey, moving from one chapter of one’s life to another.

Therefore, when people do move home, it shows they are moving forward in their lives, which gives a great indicator of the property market's health.

It’s going to be an interesting year for 2023 Iver property market.

My opinion. Do what is suitable for you, your family, and your finances.

Ignore the newspapers and look at the facts in hand and if you want a frank chat about the Iver property market, irrespective of whether you want to sell or not, call me. I might not tell you what you want to hear, but I will tell you what you need to hear.